Table of Contents

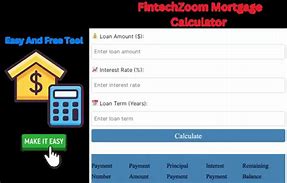

IFintechZoom Simple Mortgage Calculator n the realm of personal finance, understanding mortgage calculations is crucial. FintechZoom’s Simple Mortgage Calculator is a powerful tool that aids individuals in comprehending their mortgage options. This article delves into the intricacies of mortgage calculation, providing insights into its significance and practical applications.

Understanding FintechZoom Simple Mortgage Calculator

FintechZoom Simple Mortgage Calculator calculations form the bedrock of financial planning for homeownership. Whether you’re a first-time buyer or looking to refinance, comprehending these calculations is paramount. FintechZoom’s Simple Mortgage Calculator simplifies this process, offering clarity and precision. FintechZoom Simple Mortgage Calculator

Types and Categories of Mortgages

Mortgages come in various forms, each catering to different financial situations and preferences. Understanding these types is essential for selecting the most suitable option. FintechZoom Simple Mortgage Calculator

Symptom Analysis

Symptoms of financial uncertainty often manifest in the form of confusion and stress when dealing with mortgage-related calculations. FintechZoom’s Simple Mortgage Calculator alleviates these symptoms by providing clear and concise information. FintechZoom Simple Mortgage Calculator

Causes and Risk Factors

The complexity of mortgage calculations can stem from various factors, including interest rates, loan terms, and down payments. FintechZoom’s Simple Mortgage Calculator mitigates these complexities, empowering users to make informed decisions.

Diagnosis and Tests

In the realm of personal finance, diagnosis involves assessing one’s financial health and determining the feasibility of homeownership. FintechZoom’s Simple Mortgage Calculator serves as a diagnostic tool, providing insights into affordability and loan options.

Financial empowerment is the cornerstone of effective mortgage management. FintechZoom’s Simple Mortgage Calculator offers a range of treatment options, from budgeting strategies to loan comparison tools, fostering informed decision-making.

Preventive Measures

Proactive financial planning is key to avoiding mortgage-related pitfalls. FintechZoom’s Simple Mortgage Calculator equips users with preventive measures, such as early repayment planning and interest rate monitoring, to secure their financial future.

Personal Stories or Case Studies

Real-life experiences offer valuable insights into the practical applications of mortgage calculations. Hear from individuals who have benefited from FintechZoom’s Simple Mortgage Calculator in navigating their homeownership journey.

Expert Insights

Industry experts provide invaluable guidance on mortgage management and financial planning. Discover their perspectives on the role of technology, such as FintechZoom’s Simple Mortgage Calculator, in shaping the future of personal finance.

Conclusion

In conclusion, FintechZoom’s Simple Mortgage Calculator emerges as a pivotal tool in demystifying mortgage calculations. Its intuitive interface, comprehensive features, and real-time insights empower individuals to make informed decisions, paving the way for a secure financial future.

Read Also: Smoothstack Lawsuit: Understanding the Legal Battle and Its Implications