Table of Contents

Introduction

hot own loan interest rates for 2025 naijalovetips.com As we approach 2025, the landscape of loan interest rates continues to evolve, impacting borrowers and lenders alike. Staying informed about the latest trends in loan interest rates is crucial for making smart financial decisions. In this article, we will explore the projected hot own loan interest rates for 2025 and provide insights to help you navigate the financial market.

Understanding Loan Interest Rates

Loan interest rates are the cost of borrowing money from a lender, expressed as a percentage of the principal loan amount. These rates can vary based on several factors, including economic conditions, monetary policy, and the borrower’s creditworthiness.

Factors Influencing Loan Interest Rates in 2025

- Economic Growth: The pace of economic growth significantly impacts loan interest rates. A robust economy typically leads to higher rates as demand for loans increases, while a sluggish economy can result in lower rates to stimulate borrowing. hot own loan interest rates for 2025 naijalovetips.com

- Inflation: Inflation rates play a crucial role in determining interest rates. Higher inflation usually leads to higher interest rates to counteract the decrease in purchasing power. hot own loan interest rates for 2025 naijalovetips.com

- Monetary Policy: Central banks, such as the Federal Reserve, influence hot own loan interest rates for 2025 naijalovetips.com interest rates through their monetary policy decisions. Changes in the policy rate directly affect loan interest rates.

- Credit Market Conditions: The overall health of the credit market, including the availability of credit and the level of risk perceived by lenders, can also impact interest rates. hot own loan interest rates for 2025 naijalovetips.com

Projected Loan Interest Rates for 2025

Financial analysts and experts have made several predictions about the trend of loan interest rates for 2025. Here are some key projections:

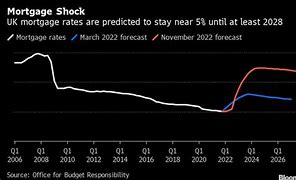

- Mortgage Loans: Mortgage rates are expected to rise slightly due to anticipated increases in the federal funds rate. Analysts predict average mortgage rates to hover around 4.5% to 5.0%. hot own loan interest rates for 2025 naijalovetips.com

- Personal Loans: Personal loan interest rates may see a modest increase, with rates likely ranging from 10% to 12% for borrowers with good credit. hot own loan interest rates for 2025 naijalovetips.com

- Auto Loans: Auto loan rates are expected to remain relatively stable, with a slight uptick, averaging between 4.0% and 6.0%.

- Student Loans: Federal student loan interest rates are projected to increase marginally, while private student loan rates will vary based on the lender and borrower’s credit profile.

hot own loan interest rates for 2025 naijalovetips.com

- Improve Your Credit Score: A higher credit score can help you secure lower interest rates. Pay your bills on time, reduce outstanding debt, and monitor your credit report regularly.

- Shop Around: Compare offers from multiple lenders to find the best rates and terms for your loan.

- Consider Fixed vs. Variable Rates: Decide whether a fixed-rate or variable-rate loan is best for you. Fixed rates provide stability, while variable rates may offer lower initial rates but come with the risk of increases over time.

- Negotiate: Don’t hesitate to negotiate with lenders for better rates, especially if you have a strong credit profile and stable income.

Conclusion

Understanding the projected loan interest rates for 2025 is essential for making informed financial decisions. By keeping an eye on economic indicators, improving your credit score, and shopping around for the best rates, you can secure favorable loan terms that align with your financial goals. Stay informed and proactive to navigate the evolving financial landscape successfully. Utilizing an interest rate calculator can further enhance your planning by accurately estimating potential repayments and total interest costs.

Read Also: Gaming defstartup: The Ultimate Guide to Building a Successful Gaming Startup 2024